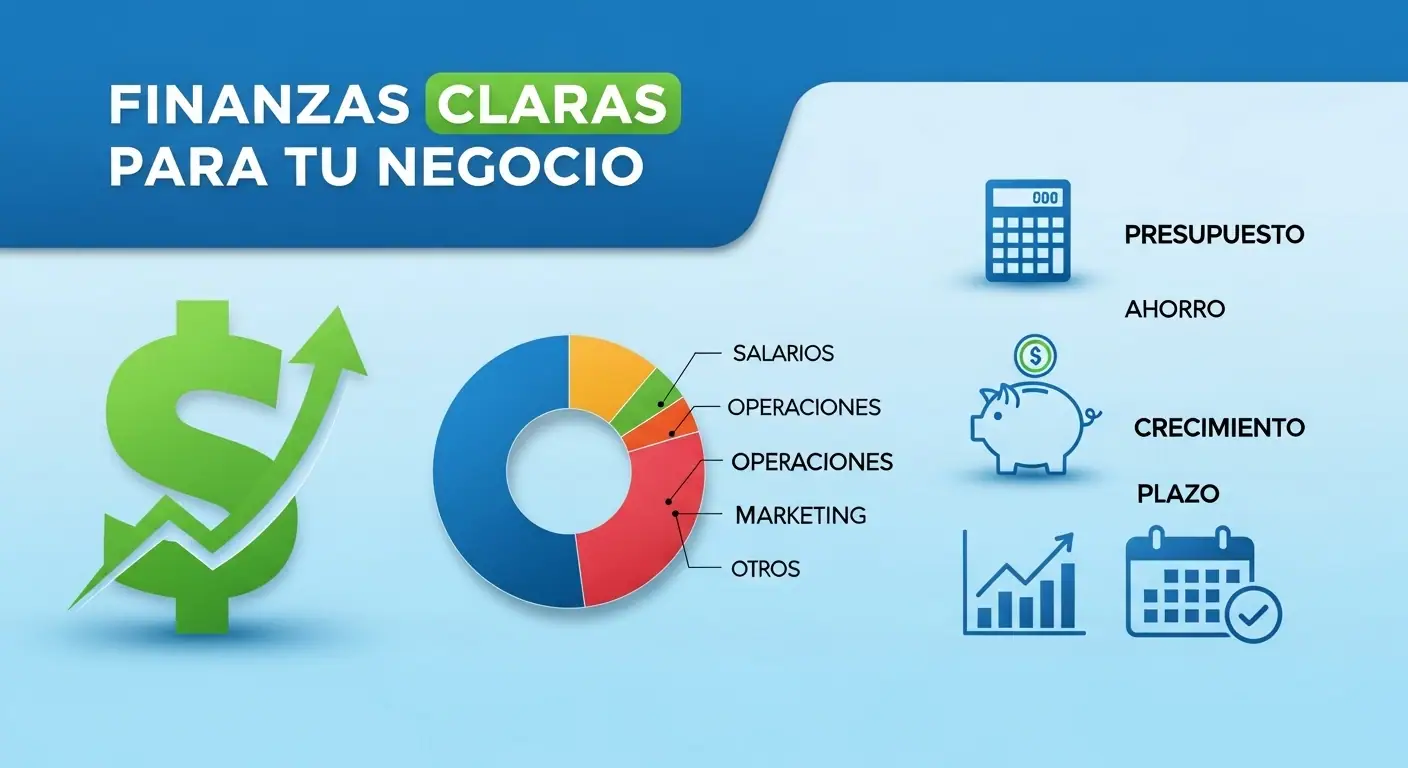

Small Business Finance Mastery

Your Compass to Sustainable Profitability and Smart Financial Control

???? Assess Your Financial HealthWhy Mastering Your Business Finances Is Your Smartest Strategy

Let’s be clear: understanding your business finances might seem intimidating, but it’s the most important skill you’ll develop as a business owner. It’s not about becoming an accountant—it’s about having control. Financial management is the difference between guessing and making strategic decisions that actually increase your profitability.

At YourBusinessTop.com, based on our real experience managing and optimizing business finances, we’ll teach you to translate those numbers into actions. We’ll give you proven methods and “behind-the-scenes” insights so your finances stop being a headache and become the compass that guides your business toward sustainable profitability.

You know exactly where your money is and where it’s going. You make decisions based on real data.

You identify which products/services actually generate profits and which ones are draining your business.

You plan investments and expansion with a solid foundation, not just hopes.

Many small businesses fail not from lack of sales, but from not understanding the language of their numbers.

Key Small Business Finance Statistics

of small businesses fail due to cash flow problems

of entrepreneurs don’t know their break-even point

more likely to succeed with financial control

average increase in profitability with optimized management

???? Quick Assessment: What’s Your Business Financial Health?

Answer these key questions and discover your main financial focus area to increase your business profitability.

???? Your Personalized Result:

???? Essential Financial Calculators for Your Business

Practical tools to calculate key business metrics. Get immediate results to make better financial decisions.

???? Profit Margin Calculator

âš–ï¸ Break-Even Point

???? Return on Investment (ROI)

???? Cash Flow Projection

The YourBusinessTop Method for Your Finances

You don’t need a finance degree to manage your business successfully. Our approach is based on simplicity, applicability, and direct experience with small businesses:

- Finance Based on Real Experience: We share financial methods we’ve used and simplified for small and medium business management.

- From Data to Profitability: Every financial concept connects directly to how it impacts your business profitability.

- Holistic Finance: We cover both sides of the coin: understanding where money comes from and, crucially, where it goes.

- Applied AI to Clarify Numbers: We show you concrete examples of how Artificial Intelligence can be your ally in analyzing financial data.

- Exclusive Tips and Agile Methods: We reveal financial tips we’ve learned through experience that give you an advantage.

Master Every Area of Your Business Finances

Dive deep into each financial strategy with our specialized guides. Each area includes proven methods, recommended tools, and real case studies.

Profitability Analysis

Learn to measure if your business is truly profitable. Methods to calculate product/service profitability, understand your break-even point, and use key financial KPIs.

Cash Flow Management

Cash flow is vital. Practical methods and templates to manage it, make simple projections, and ensure you always have the liquidity needed to operate and grow.

Cost Optimization

Understanding your costs is key to profitability. Identify, classify, and implement strategies to reduce operating expenses intelligently without affecting quality.

Pricing Strategies

Setting the right price for your products or services directly impacts profitability. Methods for value-based, competitive pricing and margin maximization.

Financial Planning

Clear budgeting and financial planning give you control and future vision. Create simple budgets and realistic financial projections for your business.

AI in Finance

Discover tools and practical examples of using Artificial Intelligence to analyze financial data, make projections, and facilitate your decision-making.

???? Financial Tips from Real Experience

Exclusive insights we’ve learned managing real business finances. Apply these tips to improve your profitability.

???? Real Profitability

Before any investment or major expense decision, ask yourself: How does this DIRECTLY impact my business profitability? Don’t spend just because “it seems like a good idea”.

???? Weekly Cash Flow

Review your cash flow weekly, not just at month-end. This allows you to detect liquidity problems in time and take corrective actions before it’s too late.

???? Always Negotiate

Negotiate with suppliers, rent, services. Every small improvement in terms positively impacts your costs, improving your business profitability.

???? Total Control

Use a simple tool (spreadsheet or basic software) to record ALL income and expenses without exception. Clarity is the first step to financial control.

???? 80/20 Financial Rule

80% of your profits probably come from 20% of your products/services. Identify which ones and focus on enhancing them to maximize profitability.

???? Emergency Fund

Always maintain a fund equivalent to 3-6 months of operating expenses. This gives you peace of mind and maneuvering capacity in difficult times or to seize opportunities.

â“ Frequently Asked Questions about Small Business Finance

???? Your Next Step Toward Clear Finances and Profitability

Clear finances are the foundation of a profitable and sustainable business. Stop guessing and start using your numbers strategically to completely transform your company’s results.

You have all the information and tools you need to get started. Now it’s time to act. Use the calculators, apply the tips, and start making smarter financial decisions.